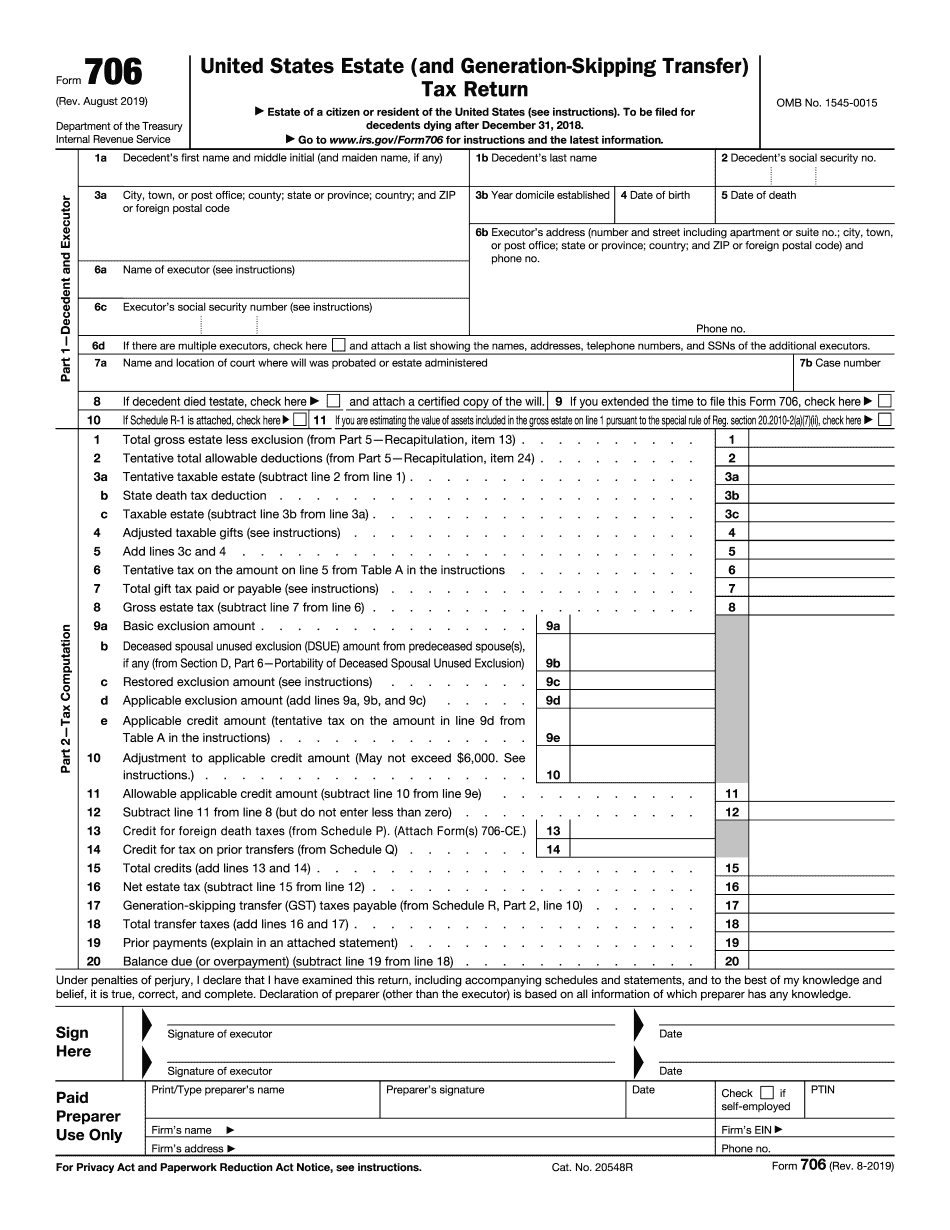

Irs Form 706 for United States Estate Tax Return 2019-2025

Show details

Hide details

Ule PC or Form 843 if not filed with Form 706. Attach Form s 706-CE. Credit for tax on prior transfers from Schedule Q. Total credits add lines 13 and 14. The executor completes the Schedule R-1 Form 706 and gives you two copies. File one copy and keep one for your records. To file a protective claim for refund or notify the IRS that a refund is being claimed in a form separate from the Form 706 instead use Form 843 Claim for Refund and Request for Abatement. They are allowable as an income ...

4.5 satisfied · 46 votes

form-706.com is not affiliated with IRS

Filling out Form 706 online

Upload your PDF form

Fill out the form and add your eSignature

Save, send, or download your PDF

A full guideline on how to Form 706

Every person must declare their finances in a timely manner during tax period, providing information the IRS requires as precisely as possible. If you need to Form 706, our reliable and user-friendly service is here to help.

Follow the instructions below to Form 706 promptly and accurately:

- 01Upload our up-to-date template to the online editor - drag and drop it to the upload pane or use other methods available on our website.

- 02Read the IRSs official guidelines (if available) for your form fill-out and attentively provide all information requested in their appropriate fields.

- 03Fill out your template utilizing the Text option and our editors navigation to be certain youve filled in all the blanks.

- 04Mark the boxes in dropdowns using the Check, Cross, or Circle tools from the toolbar above.

- 05Make use of the Highlight option to stress specific details and Erase if something is not applicable anymore.

- 06Click the page arrangements key on the left to rotate or remove unnecessary document sheets.

- 07Verify your forms content with the appropriate personal and financial paperwork to make sure youve provided all details correctly.

- 08Click on the Sign tool and create your legally-binding eSignature by uploading its image, drawing it, or typing your full name, then add the current date in its field, and click Done.

- 09Click Submit to IRS to electronically send your report from our editor or choose Mail by USPS to request postal report delivery.

Select the simplest way to Form 706 and declare your taxes online. Try it now!

G2 leader among PDF editors

30M+

PDF forms available in the online library

4M

PDFs edited per month

53%

of documents created from templates

36K

tax forms sent over a single tax season

Read what our users are saying

Learn why millions of people choose our service for editing their personal and business documents.

What Is Form 706?

Form 706 is a tax document required by the Internal Revenue Service to calculate estate taxes. This form is necessary when an individual dies and passes on their property to their heirs. In this case the estimated property has to be taxed. It is used to properly count this rate.

The document is usually prepared by estate executors. They enact the deceaseds will and ensure that the proper taxes are paid.

The paper has to be completed in nine months after the possessors death. A six month extension may be requested by Form 4768.

Find the appropriate template on the Internet. Read attentively all the field labels before filling the gaps. It is recommended that you fill out the blank 706 with the assistance of an attorney. You will need the following details to prepare the document correctly.

- 01Decedents full name, address and Social Security Number.

- 02Executors personal data and SSN.

- 03Name and location of court where will was probated or estate administered.

- 04Figures pertaining to payments, calculations and taxes.

- 05Date, signature and firms name.

Note that you may add an electronic signature by typing, drawing or uploading it from any internet connected device. Forward the completed template to the recipient via email, fax or sms.

If more convenient, print out the blank sample with instructions and prepare it by hand. Make some copies. Send the paper via mail.

Online alternatives help you to organize your document management and improve the efficiency of the workflow. Carry out the short tutorial for you to comprehensive Form 706, stay clear of glitches and furnish it in a very well timed method:

Questions & answers

Below is a list of the most common customer questions.

If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is the purpose of Form 706?

The purpose of the tax form for reporting income and deductions, known as Form 706 is to:

Provide information about taxable income, taxable earnings, taxable benefits, and certain tax benefits to individuals, and prepare income tax returns for them, without having to file a separate return.

The form collects information from individuals for the federal government for purposes of income tax. It may also be used by businesses to report, in some circumstances, taxable benefits or other income to their employees.

Who must report information on the form?

Each taxpayer is required to provide information on the form in the following situations:

For tax years before 2018, you must report:

The following information if you are a domestic employee, as described in the Instructions for Form 2350:

For tax years after 2018, the following:

The information listed on Schedule B, Part, or Schedule C, Part, of Form 706 must be reported as an additional tax on your tax return.

Where to file the 706

File the forms on line 14 of Form 1040.

File the forms on line 16 of Part 1 of Form 1040.

File the Forms 706 for individuals only on line 14 of Form 1040, and on line 8 of Part 1 of Form 1040.

Form 706 for a business only on line 14 of Form 1040.

What information must be included on Form 706?

The information on Form 706 includes the following information, if it is submitted on the correct form and is complete:

The basic information about each employer (business or individual). The information on Form 706 includes your employer's name and the first and last name of the officer, director, partner, stockholder, owner, or operator. You can include other information that applies to the individual on the individual's Form 706. However, if the individual is a domestic employee with whom you file a joint return, you can claim the credit against your own employment taxes when filing the Form 706.

Information on your income and net self-employment income. You can provide up to 250,000 in net self-employment income (net earnings from self-employment).

Who should complete Form 706?

Answer the question for yourself. It all depends. If you do anything illegal, you may be fined and spend more time in jail. If you do nothing illegal, you may be fined and spend more time in jail.

Doesn't it look complicated?

If you don't think you could answer this question, just have someone else fill out the Form 706 for you. Most people will get through this easily. If you're a more adventurous sort you can ask a friend, a relative or a trusted friend, and you'll probably make it through this.

This page provides advice and information on filing the appropriate IRS Form 706. Please read this page and use the comments below to share your thoughts about filing the appropriate tax form for your situation.

What does Form 706 cover?

All forms have some form of advice and assistance. On this page we have been providing advice for all forms, but it is helpful to know which form a particular part of the program is for, because these parts have their own specific requirements.

For more, you can review the various forms, including general information, what to fill out, which forms have which requirements. If you do not know which form you should file, you can also view the instructions, which detail the form you should file.

This page will focus on the Form 706 (others may have other titles), the federal tax forms for which a special tax return can be filed for a person who is a resident of the United States. You may be able to file a return for your own spouse or dependent children.

Form 706 will provide detailed instructions on filing, but many people find that the general information on this page may suffice.

What is Form 706?

Form 706 is a special form of tax return that is used to make a payment to the IRS that is not refundable or exempt. The amount of the payment does not normally affect the tax balance you must pay to the federal government. You may complete a Form 706 to make a payment to the IRS.

Form 706 can be used for several purposes. In addition to making a tax payment, it is useful for several other things. If you live or work outside the United States, you may be able to use Form 706 to:

Complete an ITIN application to reduce or eliminate your tax obligation to the IRS in some cases.

When do I need to complete Form 706?

When an employee becomes pregnant. The employee is required to complete Form 706 within 20 days of the woman's last day of work, even if the child's expected birthdate is weeks or months before or after the employee's due date. Therefore, it is possible that an employee would owe an unexpected tax bill if she misses an estimated delivery day.

What is a child care deduction for a newborn employee covered by a qualified employer-provided child care benefits plan?

A newborn employee under the age of 19 (or 20, if the employee is a member of the uniformed services) who has worked with the employer for 6 or more months is eligible to exclude 1,000 annually from tax withholding for up to the first 5,000 of annual wages paid to the employee on or after July 1, 2007. The amount of the exclusion is only available for the first 3 quarters of the calendar quarter in which the employee reaches age 19 and for the first 3 quarters of the calendar year in which any quarters do not amount to 3 quarters.

Employee-provided child care benefits are not covered by the Federal Insurance Contributions Act and, therefore, it would be necessary for the employer to make the payment directly to the child's parent or guardian. The payment must be sent by first class mail, or the employee may elect to have the payment placed in a money order or other form of payment acceptable to the IRS. If the employee is a member of the uniformed services, the (payer) of the child care benefits must provide that the payment be made out of funds provided in accordance with section 1002(a) of Title 10, United States Code.

What types of benefits do I have to file a Form 706 if I am covered by an employer-sponsored retirement plan but use a nonqualified retirement plan?

You must complete and sign the Form 706, Claim for Exclusion from Tax Withholding on Certain Distribution of Lump Sum Distributions, as applicable, to apply.

To obtain tax relief under this section, you must indicate why you are claiming this deduction. You must also indicate the year in which you withdrew the money, the method the money was used to pay for the qualified expenses, and the date you withdrew the money. For more information on the types of expenses qualified for this benefit, see Publication 926, Exclusion of Deductions and Losses from Nonqualified Plans.

Can I create my own Form 706?

Although the IRS currently allows the free creation of new Form 706s, you cannot use Form 706s you make yourself. If your new Form 706 should contain material that is not available to the public, you must pay an additional 9 for each taxpayer whose information is included in the return.

You cannot use any of the IRS's electronic filing software, such as e-file, to create new Form 706s.

Do you have to file Form 706s annually? How do I pay my taxes?

Your Form 706 is filed annually with your federal income tax return. Each year, you must file the income tax return on or before April 15. However, if you wish to file a Form 706 in early March or May, you may submit that form instead and must pay the filing fee at the time of your Form 706. (However, the IRS may not accept your tax return after early April.)

How do I file a tax return after I have filed a Form 706?

Once you have filed your tax return, contact the IRS to submit an amended tax return. The IRS uses this information for audit purposes and to update other information about your return.

How can I file my return electronically?

Once you have filed your return electronically (using e-file or Paperless Return), your refund or credit will be mailed to the address listed in the tax form that you signed. If you have not received your refund or credit in payment of tax due for the year after you filed your initial return, and you did not request a refund or credit, contact the IRS and inform them of the error.

What do I do if I did not sign and file an electronic or paper-return on time?

If you did not sign and file your return electronically on time, you must return your original Form 706 and file, either online or by mail, your amended return (either e-filed or paper-filed). File the amended return by January 31 of the following year. Failure to file both returns on time may result in penalties and other damages.

How do I request a refund?

You can request a refund of tax paid on Form 844, Application for Refund of Tax Paid on a Federal Income Tax return, when you have filed your original tax return and the payment is approved by the IRS.

What should I do with Form 706 when it’s complete?

If your Form 706 is already filed because you have submitted and paid your tax on time, the IRS will process our new IRS Form 706 form (and add any applicable extra information) prior to returning your Form 706 in the mail. We will send your completed IRS Form 706 electronically to you electronically if it was mailed to you. If you received your mailed-in Form 706 electronically, you can check the status of Form 706 using the link above. At the time of filing, we will also send you our new Federal Tax Bulletin (FS-284). If your Form 706 was filed after us, we will mail you IRS Form 706 in the mail. If you were not notified of the filing requirements of your Form 706 or are not using the electronic Filing option on the IRS website, send us the completed and signed FSF-7906 (which includes Form 706) by email.

Do I have to use the form for a specific issue?

The FSF-7906 is not always needed for all issues. There are many issues covered by the following Form 706s. If one issues is not required, you can complete and submit your other forms in advance of filing your FSF-7906. If you are required to file electronically, you can still use the FSF-7906 to ensure that you properly file your federal tax return. However, do not send additional tax forms to the IRS when preparing any other Form 706 that is required for an individual tax return. The FSF-7906 must be used only for issues covered by the FSF-7906. For example, if a Form 706 is required for a child who is applying for a social security number from Social Security Administration, you can complete an application without filing an FSF-7906 (as long as the child meets all the other requirements of the form). If you are preparing one or more Forms 706 based on a report from the employer or other third party, you will need to use the FSF-7906 form to support your tax deduction.

What if I have more tax forms to file?

While we do not recommend that you use more forms than necessary for any single tax return, it may be appropriate if you have more than one tax issue that requires filing a tax return.

How do I get my Form 706?

How do I file Form 706?

How long is it going to take for my Form 706 to be processed?

What if I have any more questions?

Please see the Frequently Asked Questions for detailed answers to some of the most common questions.

We'll be here to answer your questions and help you navigate the process! Get in touch with the Filing Center if you have any questions at.

Our Filing Center will assist you with preparing a Filing Form 706 and will guide you through step-by-step instructions and help you complete your application.

Download a sample Filing Form 706.

What documents do I need to attach to my Form 706?

Your Form 706 needs to provide the following information:

You may find the form on the IRS website.

You need to attach two documents. The first is a Form 7465 (or 7465-EZ).

The second document must be signed by a federal tax official. The signature on the second document is necessary because the IRS can't legally accept the statement that you don't qualify for a tax credit or deduction if you have a social security number on file. For more information, go to the IRS social security number site.

What happens if I don't submit both pieces of the information needed to submit my Form 706?

You may owe a penalty. You will then receive a refund check that is sent to you as proof of your income.

What if I submit one of the two documents wrong?

You'll have to pay a 100 administrative fee to correct the error and the IRS will send a check for the full amount.

What are the different types of Form 706?

Generally speaking, the following types of Form 706 forms are used:

Agency Authorization for Non-Consensual Disclosure of Medical Information

Authorization for Non-Consensual Disclosure of Non-Health, Vital or Sensitive Private Information.

Authorization to Return a Medical Record

Authorization to Return Medical Records.

Authorization for Reexamination of a Non-Member who has a Physician's Certificate of Fitness to Practice.

Authorization to Re-Examine Non-Member.

Authorization for Reexamination of Members.

Authorization to Re-Examine Non-Members of the Senior Order of Preceptors and Retention Officers.

Health Care Plan Authorization

Health care plan authorization. This form permits individuals, trusts or other organizations to request coverage under the health care plan.

Return of Medical Records

Return medical records.

Return of records after removal by a court from the physical custody of a doctor, psychiatrist or hospital.

Return of records under federal or state jurisdiction.

Return of records by order of the court under chapter 9 of Title 42.

Rehearings

Rehearings. Medical practitioners must file Form 706 to be notified by the Court about re-hearings.

The following are some common errors in Form 706. Make sure your physician has your permission or permission has been obtained from both you and the other party.

Form 706 is used to obtain a subpoena to a court or other governmental agency, to produce and obtain medical records, to inspect patient records or for other purposes authorized by law.

There will be occasions when the court may require medical records. If you receive a subpoena for patient records, check the box to indicate that you have reviewed the health information that would be subject to the subpoenas. If a court order has been entered, it may be necessary to comply with the records demand to preserve patient confidentiality.

The form is used to determine whether an Order of Protection is in effect for a medical condition. If it is, you do not need to complete this form.

It is used to establish the name and address of a third person to whom medical records or other documents relating to your health information may be disclosed, in accordance with this agreement.

It is used the information contained in the health care provider's certificate, which may, in some cases, be used by an employer.

How many people fill out Form 706 each year?

In 2010, more than 870,000 people filed a Form 706. The total number of Form 706 returns generated in the year was 11.3 million, according to the IRS.

For Form 706 tax filers, the average refund was about 2,600. But a portion, at 3 percent of income, was tax-free money that the filer could still retain without paying taxes at all. That's called a hardship exemption.

Who are the 706 filers?

There are a lot of people filing 706 each year. The typical filer filed a Form 706 in 2009 with about 1,100 in income, so it's safe to assume they made more than average — and were therefore taxed more.

How many people file 706?

Some estimates put the number even higher: The Internal Revenue Service puts the number of 706 filers at more than 14 million with about 6 million of that number filing annually.

Who gets the most 706 refunds each year?

People with low incomes tend to get more 706 refunds. The most common reason for filing for a 706, according to IRS data, were the failure to file a Schedule A-2 returns and the failure to report or pay Social Security disability, veteran's benefits or unemployment taxes.

For people who filed for more than 500 or more in 2009 filing, the highest number of refunds — 29 million — went to those with a household income of 200,000 or less. That's just shy of the 28 million 706 filings made in 2008.

Who has the lowest percentage of 706 refunds?

People with higher incomes, especially those with combined incomes of at least 300,000.

Is there a due date for Form 706?

No. A taxpayer who wants to change the amount of withholding from their Form 706 must do so no later than March 15 of the year following the calendar year in which the modification is made. If the amount is increased within 30 days (45 days if the taxpayer is a corporation), the taxpayer must amend it, or file Form 8862 to correct the error. If the amount is increased in excess of the tax you're subject to or the amount of tax you need not have paid that year, you may file amended Form 706 with your Form 1040NR to correct the tax you owe without filing a new Form 706. You may also be entitled to file a new Form 706 with your Form 1040NR. For a full list of when you must adjust, refer to the Instructions for Form 706, later.

What if I haven't paid the tax I owed?

The IRS will not refund your refund, if you didn't pay the tax that you owe. If you don't believe there is a tax due, contact the tax center where you filed your return. Taxpayers who believe their returns are missing may be entitled to a search of the returns to verify the return information and to correct inaccuracies.

To claim a refund in a refund computation year:

Make Form 8886 or Form 8886A, depending on your filing status

or, depending on your filing status File with IRS by April 15 of the taxable year in which the claim is made (generally April 15 of the year following the calendar year in which the claim was made, if you paid taxes this year)

Pay a fee

Claim an additional refund

Where do I report the amount of Form 706 withheld on my income tax return?

You must report the amount of Form 706 withheld on your return. This amount will be shown on the Form 1040NR, 1040A and 1040NR-EZ if you did not file a Form 706. If you filed a Form 706, you may have either an annual amount of Form 706 withheld or the actual amount withheld.

What happens if I don't pay the tax?

Depending on your circumstances, you may qualify for a special “payment extension.

Popular Forms

If you believe that this page should be taken down, please follow our DMCA take down process here