Award-winning PDF software

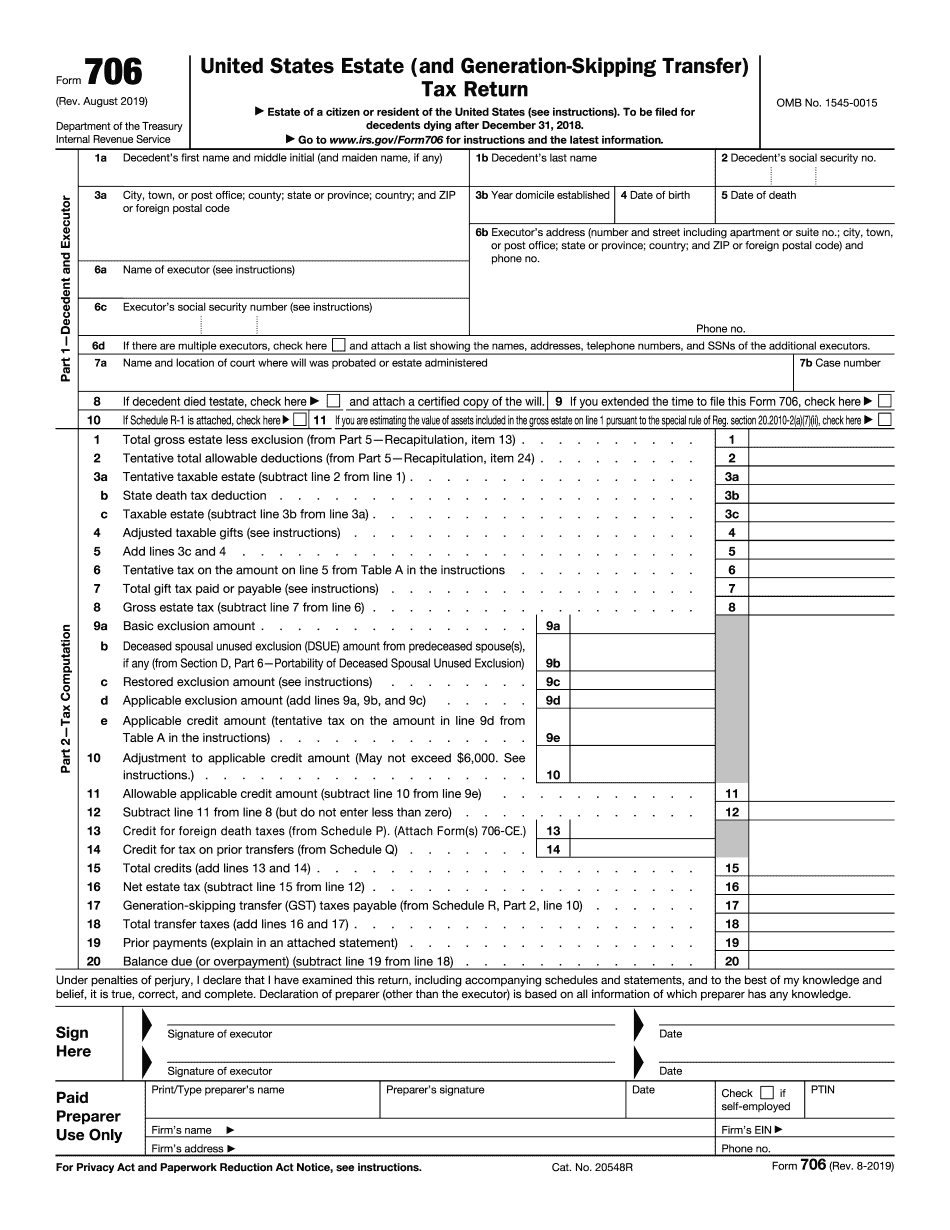

Form 706 online Kentucky: What You Should Know

However, the IRS recommends a nine-month time limit beginning July 28, 2022, in lieu of the requirement that returns be filed within ninety days after the decedent's date of death. Form 706 is one of the largest estate tax returns the Internal Revenue Service receives. The IRS is required to make adjustments to the return every couple of years in order to reflect changes in the value of the estate. If you received an “invalid or incorrect report” form or are subject to a refund, you may submit a corrected return for the applicable tax year in which you receive a defective report. A certified copy of the return will serve as substitute for a completed and signed seven (7) page Form 706. Kentucky State Tax Returns The state of Kentucky has four tax periods. The first and last two consist of three months each of April and July. For the first three-month period, tax is due after April 1st, for the second three-month period it is due on April 15th. The final three-month period in the year is January 1 to June 30, which consists of ten months. There are no income tax brackets with Kentucky, which is one of the primary benefits. There is no tax on capital gains. The only income that Kentucky tax is due is the gross income from a business or profession that is carried on by the decedent. The annual rate for the gross income that is subject to tax is 9% of its value. The exemption is 8,500 for individuals and 10,000 for married couples filing jointly. There is a 500 deduction for dependent care payments. There is no tax on any amount over these amounts. Capital gains are also exempt on the initial sale of most stocks, bonds, and other forms of capital investment. If the decedent owned investments through a brokerage firm, the cost of the investment will be reported on Schedule B (Form W-2). The state of Kentucky also has an income tax of 6% for the first 3,000 of taxable income, and 0% for income over this amount. A married couple filing jointly would owe 8,000 for the tax year, not plus tax, if each earned a combined income of 18,000. Under Kentucky code section 5.05B, a partnership income tax is due on the combined income of a married couple with combined taxable income of 30,000.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 706 online Kentucky, keep away from glitches and furnish it inside a timely method:

How to complete a Form 706 online Kentucky?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 706 online Kentucky aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 706 online Kentucky from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.