Award-winning PDF software

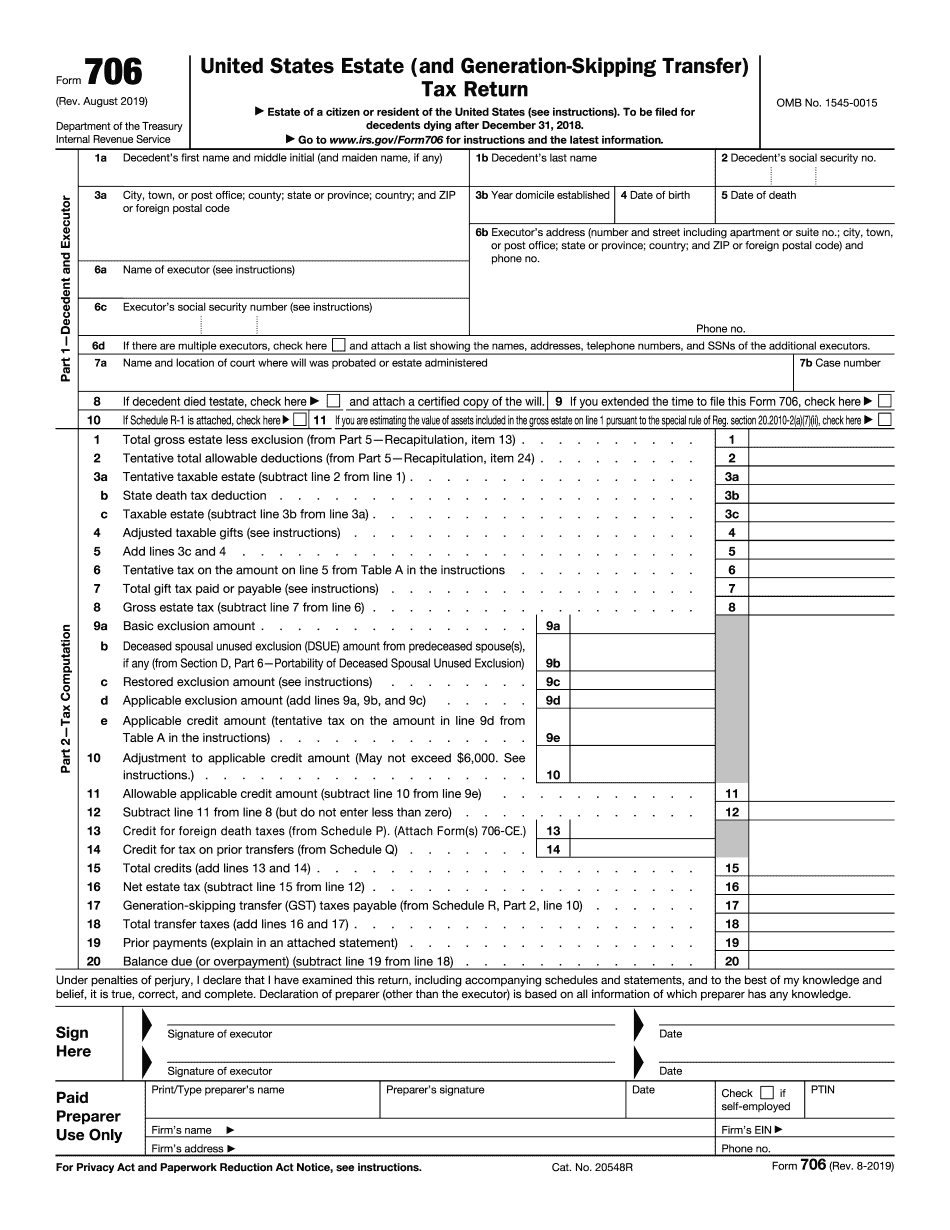

King Washington Form 706: What You Should Know

Will be collected from the owner. Real Estate Excise Tax (MEET) — Seattle Jan 8, 2025 — In July 2018, Seattle City Council passed an ordinance increasing the Real Estate Excise Tax by 10% for the second half of this year to fund construction of the Downtown Seattle Transit Tunnel. This law was effective July 1st, 2018. City of Seattle Property Tax Rate Information To see how much and how often your property is assessed; look up your property value on the Real Estate Excise Tax Website. To see if there are any changes to the tax in the near future, click 'Property Tax' for a list of upcoming tax rates. Real Estate Excise Tax (MEET) — King County Jan 8, 2025 — The City of Tacoma and the City of Mercer Island have implemented a Real Estate Excise Tax on property located in those cities. As a result, property owners in those cities will be charged an additional rate of 4.50% on taxable real property sold on or after January 8, 2019. The tax is collected on taxable real property sold in Mercer Island and the City of Tacoma on or after April 1, 2019. The additional cost to the property owner is paid by the purchaser at the time of purchase. The tax starts at the current 2.00% rate and increases for each of the four calendar years following the effective date. The City of Tacoma's Excise Tax rate is 2.66% with a tax due each year from May 1, 2018, to August 31, 2021. King County's Excise Tax rate starts at 3.33% and increases each year until tax payments are due on April 1, 2020. Capital Gains/Distributions — Seattle Capital gains/distributions are also taxable unless they are “qualified dividend.” For more information, click here. Capital gains/distributions — capital gains are capital gains on stock certificates or other non-dividend-paying securities from a transfer of stock in a partnership or corporation in or from an S corporation (stock with no voting power), S corporation stock from an individual in a divorce or death, or from an individual in a stock purchase.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete King Washington Form 706, keep away from glitches and furnish it inside a timely method:

How to complete a King Washington Form 706?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your King Washington Form 706 aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your King Washington Form 706 from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.