Award-winning PDF software

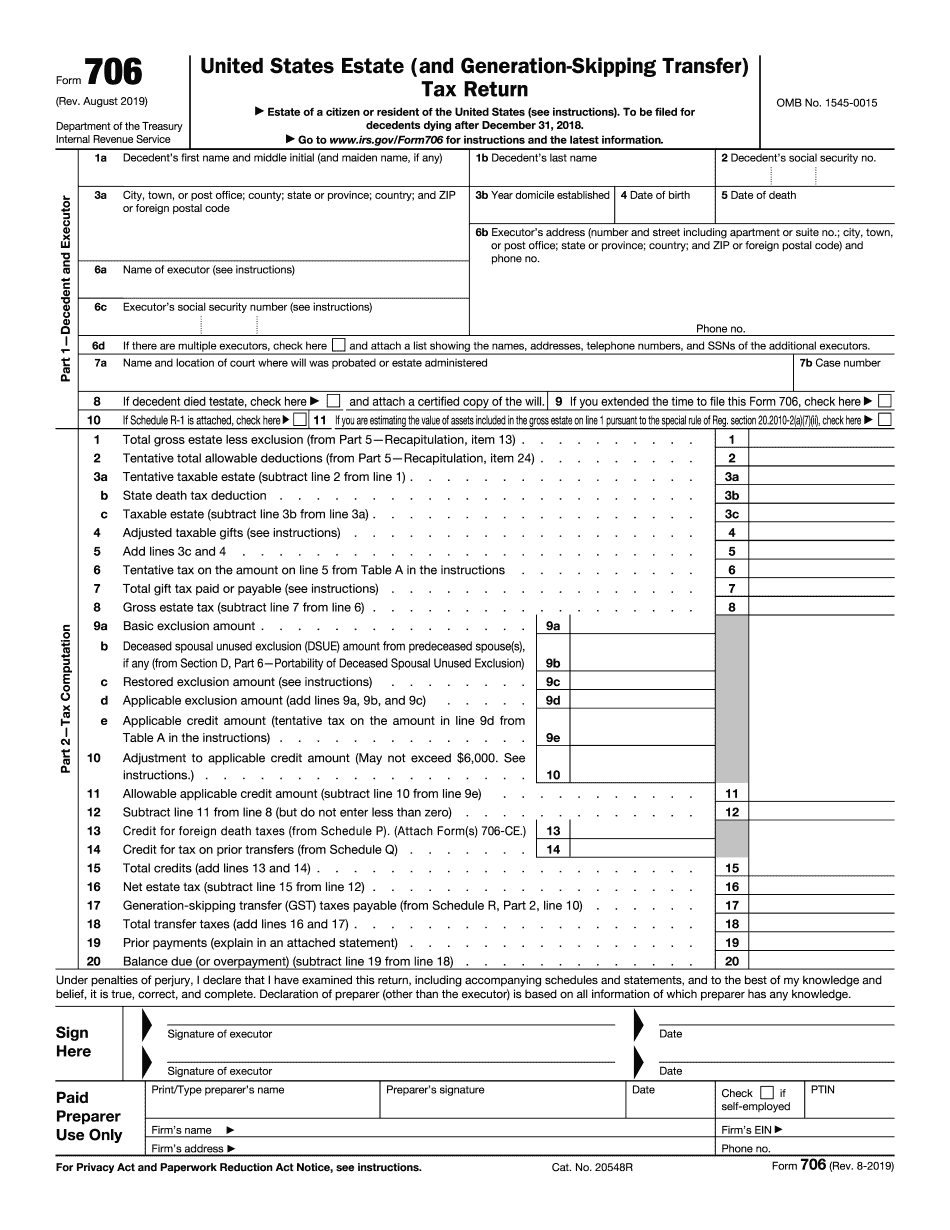

Printable Form 706 Las Cruces New Mexico: What You Should Know

This form provides each taxpayer with a schedule of rates, which applies only to income tax withheld from each pay check or direct deposit. The rates are then applied to each taxpayer's total gross income for his or her tax period. A tax return is filed every two years on April 15th — March 15th if the taxpayer is filing a New Mexico individual taxpayer return (Form 01.49), or every two years on April 15th if the taxpayer is filing a New Mexico partnership return (Form 01.49, plus Form 2.49). New Mexico is one of the few states that have income taxes imposed on those working on a farm. This is called the Farm Business Income Tax, and includes farm and ranch property (including livestock) income, and other income derived from farm or ranch operations, as well as certain farm and ranch income earned by an individual who owns farm or ranch property as an investment. Form 01.49 — Individual Return — This is a New Mexico individual income tax return (Form 01.49), which you will file by April 15th every year (or April 15th of the year in which the return was filed). If you are filing the 2025 tax return, you will have to file a new return if you have any of the following reasons. You cannot reasonably avoid paying a higher tax rate, based on income reported for the previous year You changed your method of accounting for income The tax withheld under the current tax table is too low If you failed to use either Form 6038 or Form 6039 (Form 6038 and Form 6039, respectively, when you filed your prior year's return) to obtain the correct information on your Federal income tax return You should pay a late payment penalty For more information on filing the New Mexico personal income tax return, visit the New Mexico Department of Taxation and Finance website (click on “Filing Info” at the top of their site) Click on “Estates and Trusts” for information on Estates, Trusts and Estates/Trust Funds Click on “Business” for New Mexico Sales Tax Note: If you are filing a New Mexico sales or use tax return, you should file the sales tax return as soon as you have it, and you might file the use tax return immediately (within six months) after the sales tax return is filed. The New Mexico state sales tax rate is 3.7 percent on the total price of the product, subject to a minimum of 25.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Printable Form 706 Las Cruces New Mexico, keep away from glitches and furnish it inside a timely method:

How to complete a Printable Form 706 Las Cruces New Mexico?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Printable Form 706 Las Cruces New Mexico aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Printable Form 706 Las Cruces New Mexico from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.