Award-winning PDF software

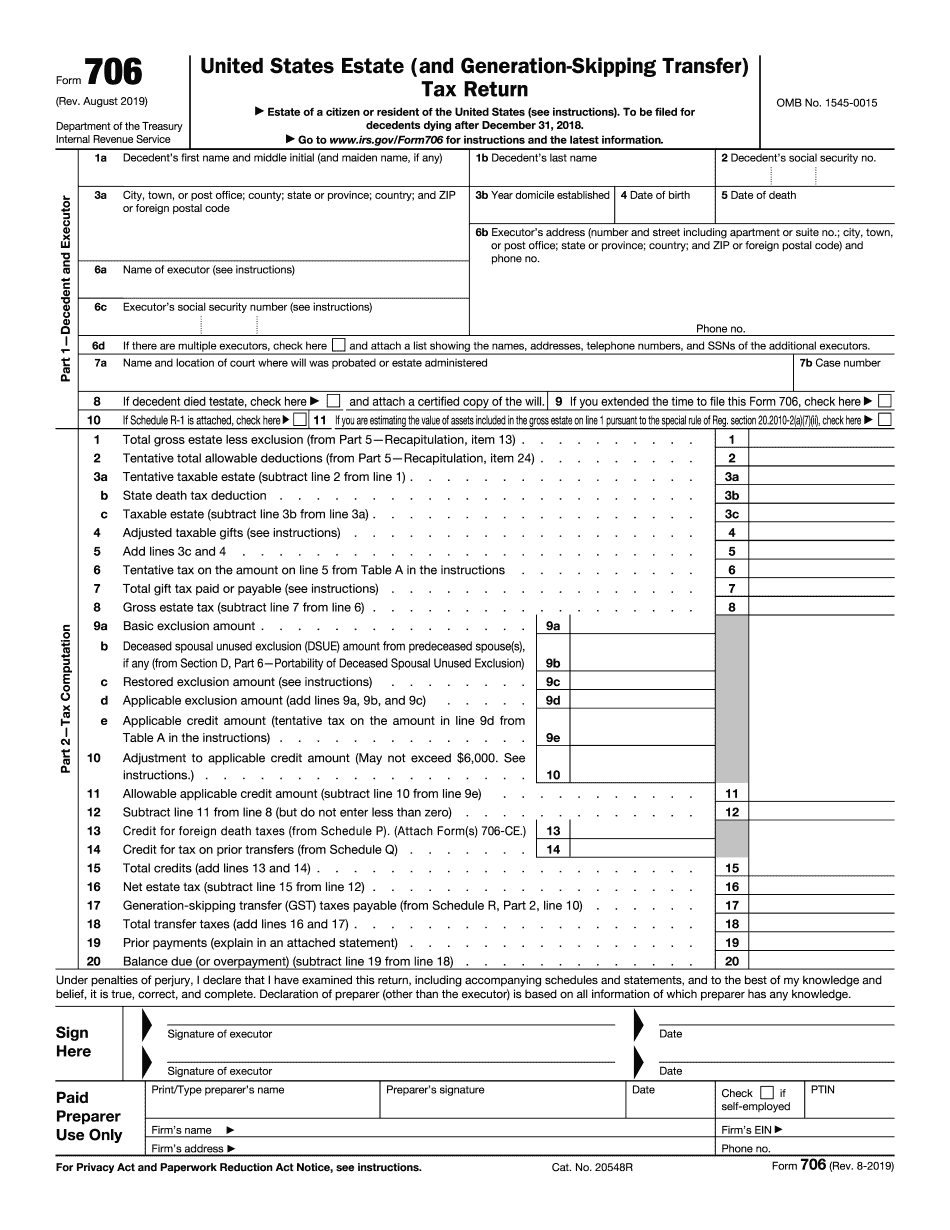

Form 706 Houston Texas: What You Should Know

Texas Department of State, Family Code Section 7201.003. Income Limitations for Federal Estate Tax Exemptions Feb 1, 2025 — In 2010, the US Supreme Court ruled that an interest in a home must be considered property within the meaning of the federal estate tax exclusion, making it subject to levy. In 2010, the US Supreme Court ruled that an interest in a home must be considered property within the meaning of the federal estate tax exclusion. Federal Estate Tax Exclusion — Publication 519, 2025 Estate Tax Act of 2025 (codified at 31 U.S.C. section §2052 note), §1. Section 2052: “No interest in real property in perpetuity may be excluded under this chapter if the interest is held— (1) by a decedent in the capacity of owner if the interest was acquired before the decedent was twenty-one years of age and the decedent was at the time of death an individual; or (2) by a decedent in the capacity of owner if the interest was acquired by gift if and only if the aggregate value of the interest and any real property conveyed or acquired with respect to the interest equals or exceeds five times the decedent's adjusted gross income for the taxable year. For purposes of this paragraph (2), any interest included in the gross income under section 2513(a)(3) must be treated as being includible in gross income for purposes of section 2052.” Interests Held at Time of Death of decedent must be Included in Estate If the decedent held only one-half interest in the property, and he disposed of the other half, he would be entitled to any tax paid on the tax on the part of the proceeds from sale that is not included in an election under this subsection (e). A partial interest held for an extended period, however, may not be subject to the exclusion under this subsection provided that the aggregate of all interest included in the gross estate of the decedent at the time of the death and disposed of after such time does not exceed the gross estate and the aggregate of the total basis and value of all interests held at time of death must not exceed the gross estate. This exemption does not extend to interests held at the time of the decedent's death by a joint tenant or other individual who was not a member of the decedent's family.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 706 Houston Texas, keep away from glitches and furnish it inside a timely method:

How to complete a Form 706 Houston Texas?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 706 Houston Texas aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 706 Houston Texas from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.