Award-winning PDF software

Form 706 for Thornton Colorado: What You Should Know

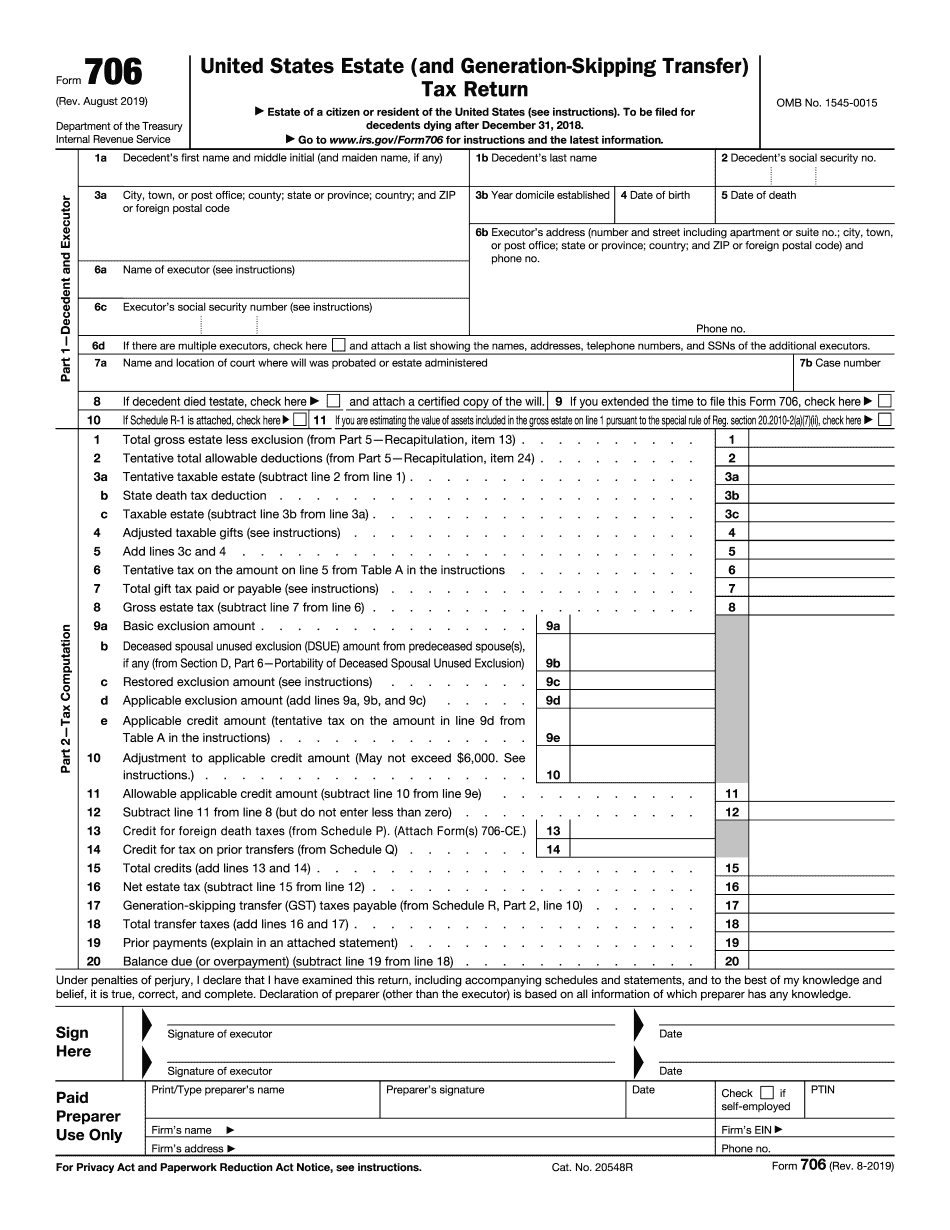

S. Citizen or resident, who survives an individual whose death occurred during the taxable year. If that individual dies after December 31, 2004, the executor of the estate of that individual must file a Colorado estate tax return if any of the following applies: In addition to filing a Colorado estate tax return for every U.S. citizen or resident who survives, the executor of an estate that has received exempt gifts from the decedent, that has a gross estate, that meets the statutory requirements for certain exemptions and exemptions, and whose taxable gifts did not exceed the gross estate or gross taxable gifts of the decedent, must file and pay Colorado state income and use tax on all the exempt gifts. Under current law, such an estate would have to pay Colorado state income and use tax on the exempt gifts received from the decedent. Under current law, it is a gross misdemeanor to fail to pay Colorado state income and use tax on all exempt gifts made through a gift tax exemption certificate. Under current law, the estate of an individual who is a United States citizen and who dies before December 31, 2004, and with a net amount in excess of 40,000,000 who has not been exempted from income tax under the provisions of the applicable provisions of Federal or State tax code of a state or of this state, and who has qualified for a state credit as an exemption from income tax, may, pursuant to the provisions of this section, deduct the excess amount from any Colorado income taxes assessed against the estate with respect to its gross estate for the taxable year in which the death occurs if all the following criteria are satisfied: (1) The estate's gross estate is not subject to Federal estate tax for the death years in which the death occurred and the decedent's applicable exemption has not been granted. (2) The estate is no later than six months after the death of the decedent in this state if the decedent had been a resident of this state. (3) For estate tax purposes, the term 'the estate' includes all persons who are related by marriage within the second degree of consanguinity or affinity and (4) The estate, at the time it is the subject of the death tax determination, is not a disregarded entity for any other reason, such as a nonresident estate.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 706 for Thornton Colorado, keep away from glitches and furnish it inside a timely method:

How to complete a Form 706 for Thornton Colorado?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 706 for Thornton Colorado aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 706 for Thornton Colorado from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.