Award-winning PDF software

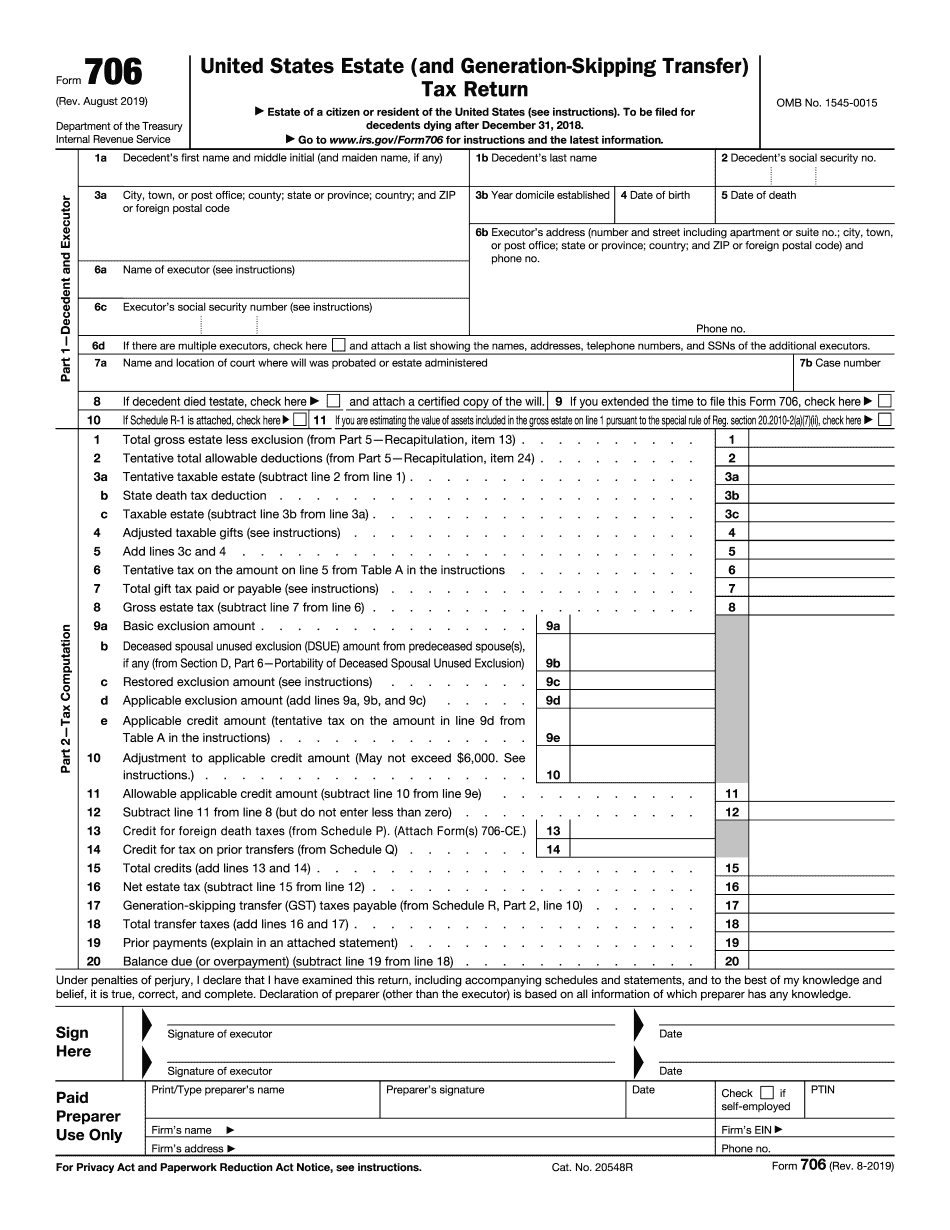

Form 706 for Tacoma Washington: What You Should Know

If the estate has a gross estate of more than 200,000 (and the spouse has joint tax liability), then the executor must file a Form 706. (The gross estate can be up to 400,000 for non-resident married couples.) The tax must not exceed the excess of the taxable estate over one-half of the qualified lower exemption (USED) and two-thirds of the excess over 2,020,000. When filing the form, the executor may not have any income from, interest in or profits from a business (other than a closely-held family business and income from sources within Washington state). There is a 100,000 deduction. This is only a tax return, and not a legal document. For more information on Washington estate tax return filing, please visit the following link Washington estate tax forms For information on the state tax that is imposed on your Washington State estate, please visit the following link What To Do If You Make a Nonresident Will? Your nonresidents personal property can include real property within Washington State or personal property shipped outside the state before the will is made. The property must be sold and transferred to the executor of the will within 30 calendar days of death unless the executor waives this time requirement. (Note: The executor can transfer the real property in Washington State when the executor transfers the property to a Washington trust.) If you make a nonresident will, then the state of the property, its name on the decedent's death certificate, the amount of any gifts in excess of what's given through the will and the value of real property or property shipped outside WA prior to the will being made, but not including property being transferred pursuant to a trust, must be filled out on your WILL. For more information about Washington death certificates, see Wash. Rev. Code §20.60.160. To file the decedents WILL or decedent's estate agreement you must have a current Washington driver's license or passport. The DOF may also be able to fill out your WILL. If you are an entity, you must fill out the WILL on the account manager's behalf. DOF also administers the Washington Estate Tax Returns. If you would like to know how to file a WA estate tax return, please visit the DOF's website.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 706 for Tacoma Washington, keep away from glitches and furnish it inside a timely method:

How to complete a Form 706 for Tacoma Washington?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 706 for Tacoma Washington aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 706 for Tacoma Washington from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.