Award-winning PDF software

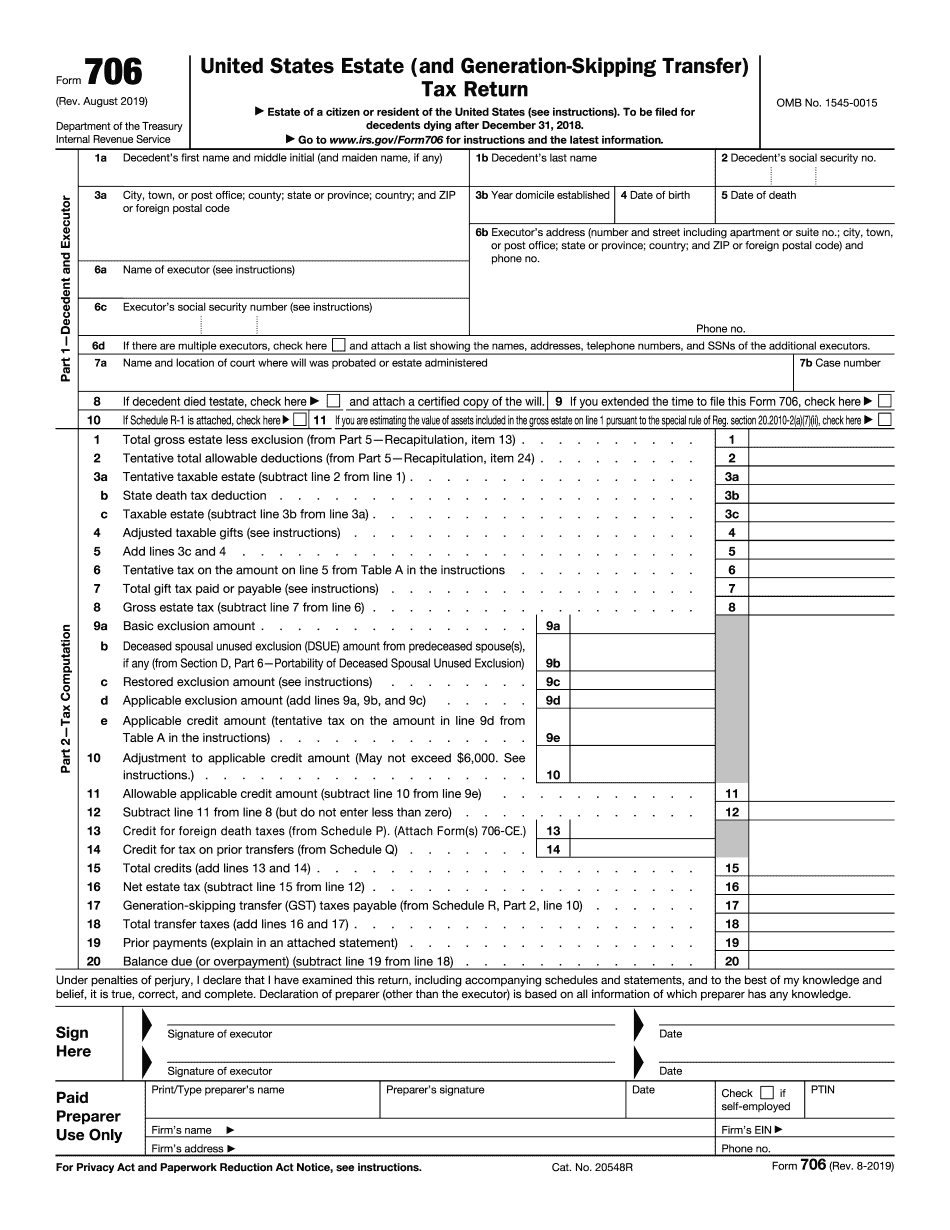

Form 706 for Eugene Oregon: What You Should Know

There could also be more taxes to pay. If someone owns land in Oregon they could be paying more taxes than property in Oregon's other state. What This Means for You 2023 Estate Trusts — A Taxing Legacy Oct 24, 2025 — The tax-free estate tax at the federal level in Oregon was abolished in 1994. It is still not gone, it is just gone from federal return. As of Jan 1, 2026, tax-free federal estate would reappear on your state return. But now it is worth 2.6 Million. You could get it back if you transfer to another person, or you die in Oregon after you died. The tax-free federal estate tax exemption is 3.5 Million. If the tax-free estate tax exemption is 2.6 Million or more, you can get tax-free estate to a spouse or to a surviving spouse. Also, you can transfer property, including real estate, at or before age 65 to a surviving spouse, your children, grandchildren, great-grandchildren, or great-great-grandchildren, and you can transfer at or before age 64 to each of them to take advantage of the tax exemption. You're surviving spouse can file a return or a return can be filed on your behalf. Here's a good article about it. Estate Trusts: Tax Benefits for Married Couples, Published April 21, 2004, by the Oregon Bureau of Revenue. If you are married and have one spouse who is not in the military, you can use a Form 707 to reduce the tax due on your estate (inherited or acquired). Do not use this for property acquired before you attained age 65. If you have no spouse, you can take these benefits, but your federal estate will not be tax-free and the value of your estate will be zero. If your federal estate is taxable or your spouses are married to each other, the maximum federal estate tax is equal to the value of the estates of both spouses added together. If there are no surviving spouse/children at death, at any stage of the marriage or later, you can take these tax benefits. See: Oregon Estate Tax, Federal Estate Tax Benefits, and Federal Estate Tax on the Burdens of the Death of a Spouse.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 706 for Eugene Oregon, keep away from glitches and furnish it inside a timely method:

How to complete a Form 706 for Eugene Oregon?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 706 for Eugene Oregon aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 706 for Eugene Oregon from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.