Award-winning PDF software

Form 706 College Station Texas: What You Should Know

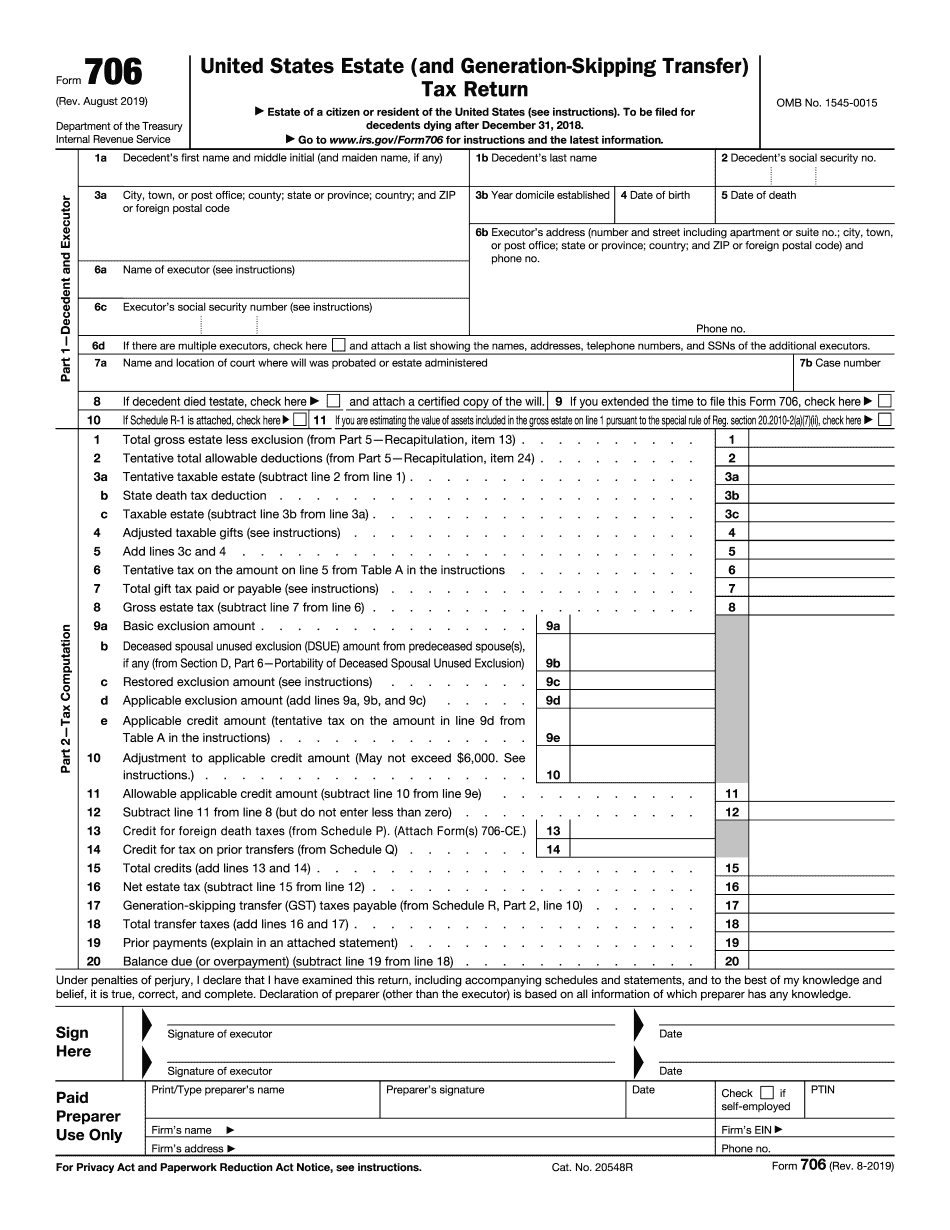

Any other U.S. citizen who receives an estate for which an executor is required to compute the FINE (from which only the portability of the FINE will be computed) c. Any other non-U.S. citizens living outside the United States and its outlying possessions who, in the judgment of an executor after full and fair consideration of the facts and evidence, may be relieved from liability, and upon the filing of an application for relief, is entitled or may be required to make provision for the payment of FINE or COUNT on the estate d. The executor is in deliberate violation of provisions of the estate law or who fails to act to correct such violation after notice and opportunity for hearing under the provisions of the estate law. You can read the instructions for Form 706 (Rev. August 2019) (PDF) to figure out what you must do if your executor didn't follow the instructions in the 2 version! The instructions in the 2 version are very similar to the instructions outlined in the 2025 version. Sep 15, 2025 — For decedents who died in 2022, Form 706 must be filed by the executor of the estate of every U.S. citizen or resident who: a. Who is a resident of a foreign country b. Did not have a U.S. mailing address at the time of death c. Did not have an executor to represent them in the estate d. Who died within ten years after a court order was made directing payments to an estate that is subject to a court order, or to an estate that has been ordered to distribute payments to another estate for default. e. Who had no surviving spouse at the time of death? f. Who was subject to a court order directing payments to an estate that is subject to a court order, or who has been called to account for the payments. Instructions for Form 706 (Rev. September 2022: PDF) — IRS Sep 15, 2022— For decedents who died in 2022, Form 706 must be filed by the executor of the estate of every U.S. citizen or resident who: a. Who is living outside the U.S.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 706 College Station Texas, keep away from glitches and furnish it inside a timely method:

How to complete a Form 706 College Station Texas?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 706 College Station Texas aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 706 College Station Texas from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.