Whoa, I am excited today. What's up, guys? This is Eric with Ham-Radio Concepts, KJ4. Why is the "I" capitalized in "why is the I make sure"? Make sure you subscribe to my videos, share, comment, thumbs up, and consider supporting the channel with the link in the description to help bring you better videos. And I'm going to show you this video I've been working on for a couple weeks now to show you the newest device that I have and probably the most awesome device I've ever used and owned for ham radio. Okay, this is awesome. We're going to take a flashback for a minute and go talk about PSK again. Now, if you're not familiar with PSK, I'm going to show you what I have set up right here as a really basic setup for what anybody would use on PSK 31. PSK, this is not a tutorial on phase shift keying or PSK, but I'm going to show you how to replace all this to go ultra extremely portable with my 817 with this new device. And I did use this at field day. I have a little bit of footage later in this video showing you at field day, and I'm going to show you it again in depth and great detail as much as I can - where I got it, why I got it there, and what it does. So, a basic system would be a radio, a computer with the software of your choice, and the sound card interface that kind of joins the two together for the appropriate audio levels. There's also some sort of interface that from the computer to the radio that keys the radio for transmit. Okay, this is an MFJ audio interface that I've used, but...

Award-winning PDF software

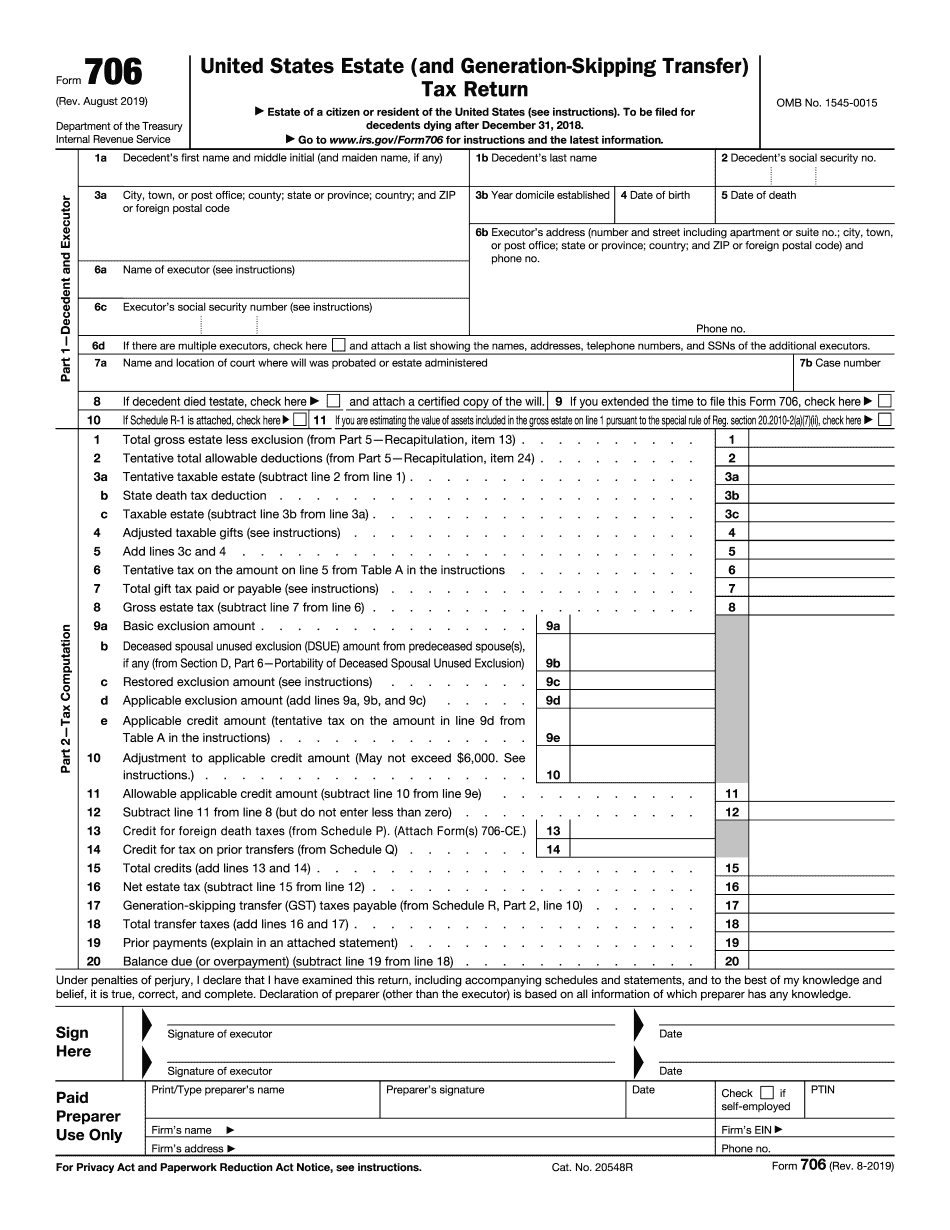

Sample 706 For Portability Form: What You Should Know

B. Section 2010(c)(6) imposes an annual percentage rate of tax on adjusted gross inapplicable gross estate of pass-through entities in each year of the four-year period under section 7706(c)(8)(C). The 2025 rates are: 3.6 % in 2025 (Form 706 filed before May 2, 2019) 4.25 % in 2019 6.13 % in 2020 13.74% in 2021 16.41% in 2025 A. Form 706 must be filed timely. In 2017, IRS created a simplified method to auto-extend certain estates. For those estates, the filing deadline is the earliest of: 1) the first day of the due date (after the close of the estate's taxable year) for a return under Section 7706(c)(10)(A) filed on or before November 30, 2017; or 2) the seventh day after the estate's last day of the applicable taxable year. This section permits executors to make the portability election without requiring the filing of an original federal return. However, executors with estates tax-deferred may make the election, provided they have filed a Form 706 with respect to a covered estate prior to the due date of an original federal return based on those proceeds. C. To elect portability, the executor must certify to the IRS his or her belief that the estate is subject to the annual percentage rate imposed by Section 1053. This election should be made on Form 706 based on the estate's current taxable income. The executor must also file a statement with the return to the form prescribed by Section 706(c) that a statement is required under this provision. 18 For estates tax deferred, the annual percentage rate is applied only to the portion of the estate that would otherwise be subject to the tax, as indicated by the estate's current tax status, as determined under section 2208. E. If the deceased's estate has more than 2 million in assets at the time of death and does not have assets subject to tax pursuant to Section 1053 because the estate was not tax-deferred at the time of death, this election applies only to the portion of the estate that exceeds 2 million at the time of death and does not allow the estate to escape imposition of the tax. For those assets that are subject to tax pursuant to section 1053, the executor must file Form 706. F.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 706, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 706 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 706 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 706 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Sample 706 For Portability